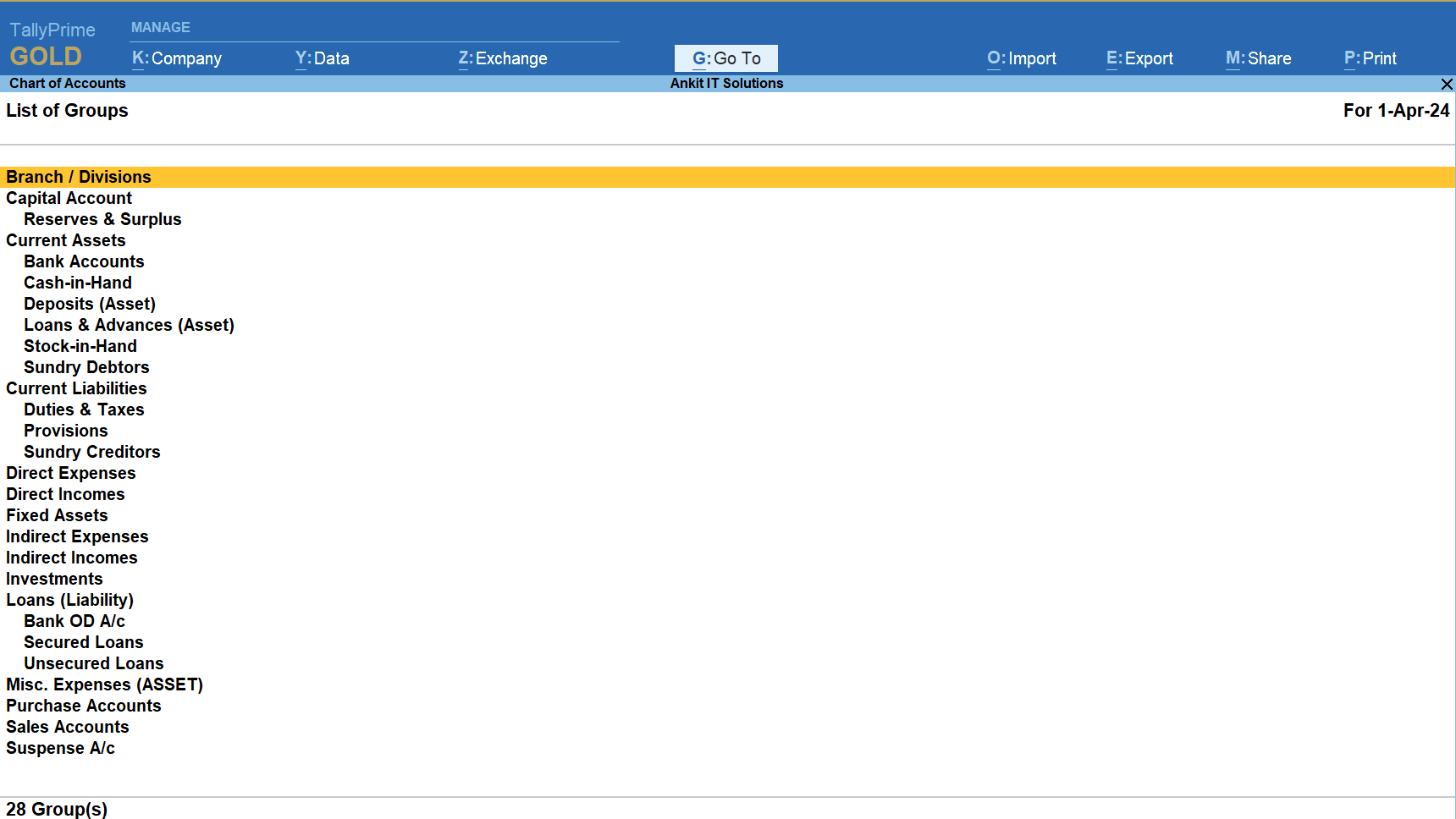

When you create a company in TallyPrime, it automatically comes with 28 predefined groups. These groups help you organize all your accounting data like ledgers, stock items, and transactions in a structured way.

Understanding these groups is very important for beginners, accountants, and business owners using Tally for financial management.

What is a Group in Tally?

In TallyPrime, a Group is used to classify ledgers into categories. This helps you:

- Easily create reports like Balance Sheet, Profit & Loss A/c, etc.

- Maintain proper accounting structure.

- Apply correct GST or inventory settings.

Types of Groups in Tally

Tally groups are divided into two types:

- Primary Groups – Main heads like Assets, Liabilities, Income, and Expenses.

- Sub-Groups – Predefined sub-categories under each primary group.

Out of the 28 predefined groups, 15 are primary and 13 are sub-groups.

List of 28 Predefined Groups in TallyPrime

Here is the complete list, grouped under their category with examples:

🔴 Capital & Liabilities

- Capital Account – Owner’s capital, reserve fund.

- Loans (Liability) – Secured/Unsecured loans taken.

- Current Liabilities – Outstanding expenses, dues, etc.

- Sundry Creditors – People/businesses you owe money to.

- Reserves & Surplus – Accumulated profits or reserves.

🟠 Assets

- Fixed Assets – Furniture, computer, building.

- Investments – FD, mutual funds, shares.

- Current Assets – Assets expected to be used within a year.

- Sundry Debtors – Customers who owe you money.

- Cash-in-Hand – Cash balance, like Petty Cash.

- Bank Accounts – SBI, HDFC, ICICI, etc.

- Bank OD A/c – Bank overdraft accounts.

- Deposits (Assets) – Security deposit, rent deposit.

- Loans & Advances (Assets) – Advance paid to staff, others.

🟢 Income

- Sales Account – All types of sales (cash/credit).

- Direct Incomes – Freight received, commission earned.

- Indirect Incomes – Interest received, discount earned.

🔵 Expenses

- Purchase Account – All types of purchases.

- Direct Expenses – Freight paid, wages (factory).

- Indirect Expenses – Salary, rent, stationery.

⚙️ Inventory Related

- Stock-in-Hand – Closing stock.

- Duties & Taxes – GST, VAT, TDS, etc.

- Provisions – Provision for tax, bad debts.

- Misc. Expenses (Assets) – Preliminary expenses.

🧾 Sales & Purchase Classification

- Branch/Divisions – For multiple locations.

- Suspense A/c – Temporary unclassified entries.

- Profit & Loss A/c – Auto-generated from income & expenses.

- Advance Income – Income received in advance.

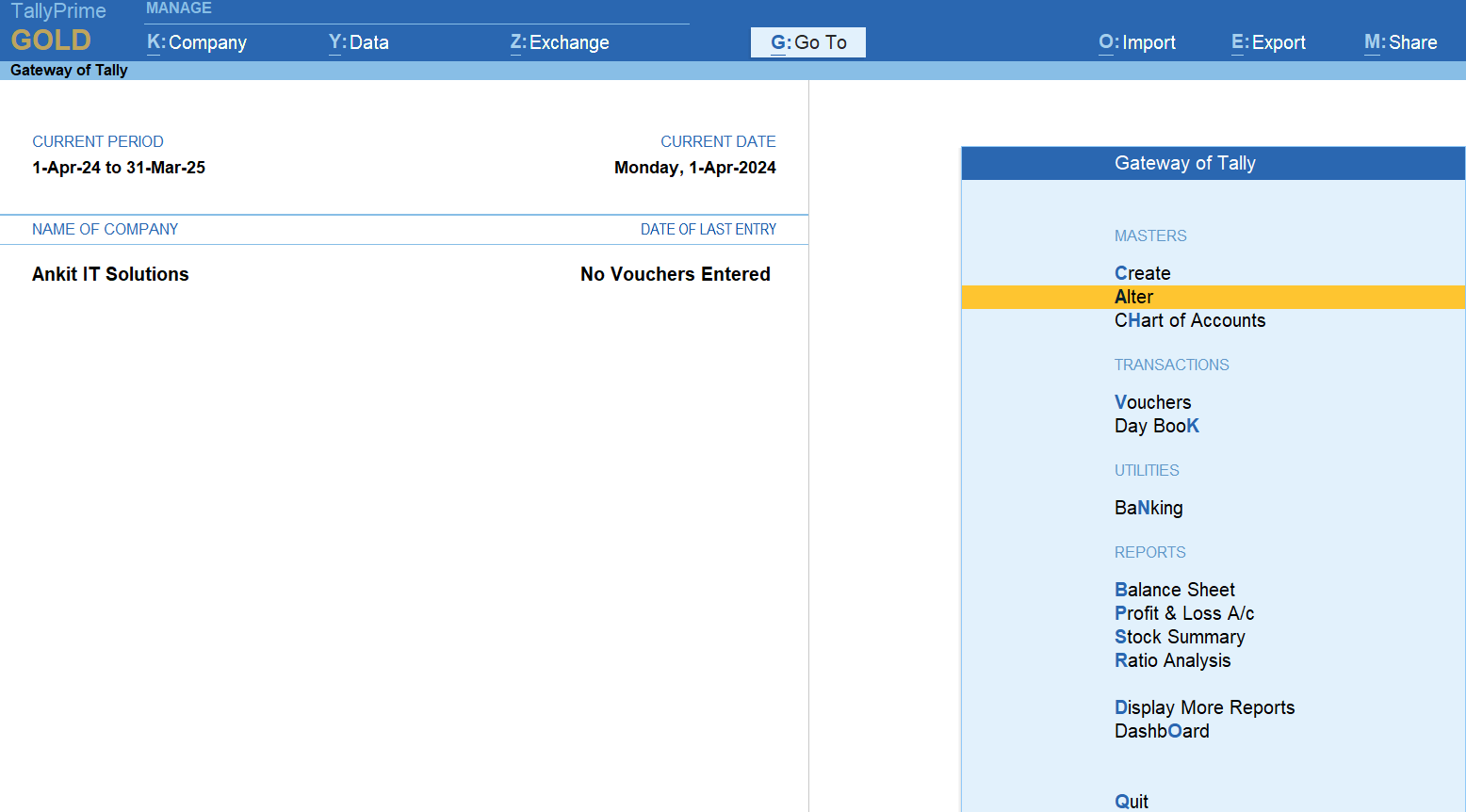

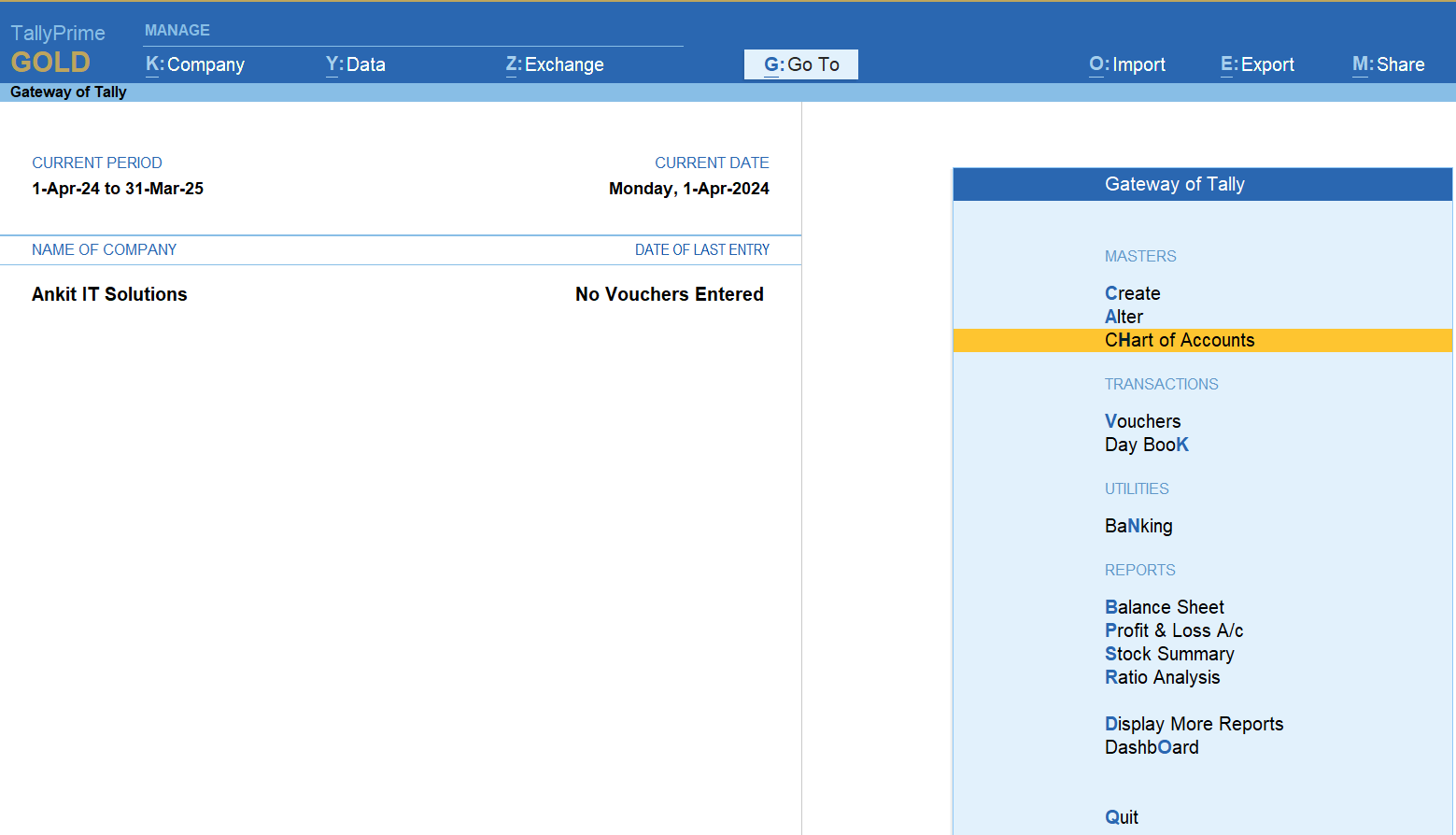

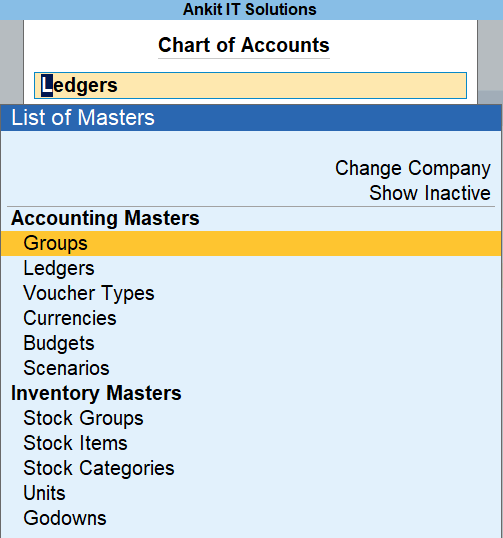

Method 1 for see the 28 predefined groups of tallyprime

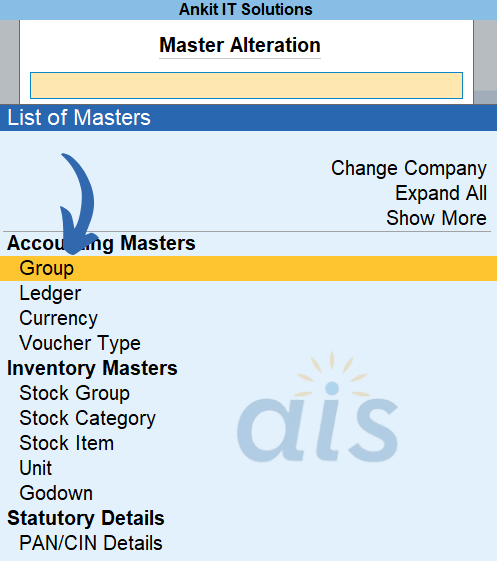

Step 1- Click on Alter

Step 2- Click on Group

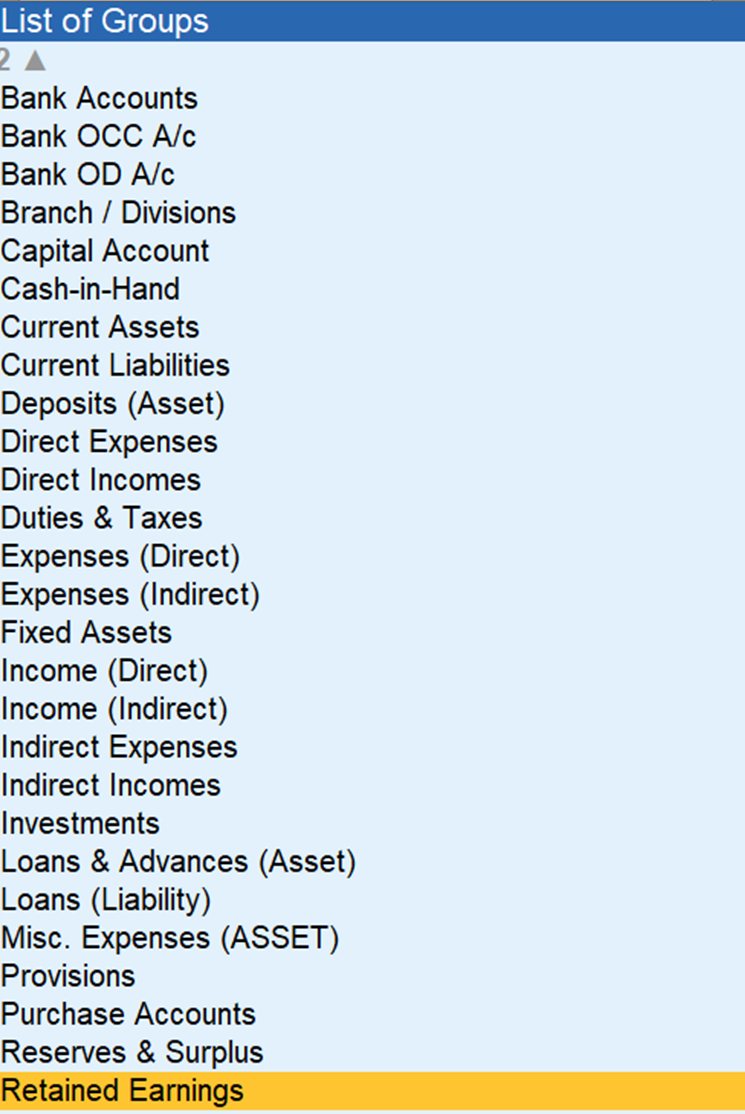

after it here are 28 predefined groups in Tallyprime you can see

Let’s explore each group with definition and 5 real-life examples for better understanding.

1. Bank Accounts

Bank ledgers contain relevant information about banks used to make or receive payments.

Examples:

- HDFC Bank A/c

- State Bank of India A/c

- Axis Bank A/c

- ICICI Bank A/c

- Canara Bank A/c

2. Bank OCC A/c (Open Cash Credit)

Used by small or medium enterprises to manage working capital through overdraft against security.

Examples:

- HDFC OCC A/c

- SBI OCC A/c

- Punjab National Bank OCC A/c

- Axis OCC A/c

- Bank of Baroda OCC A/c

3. Bank OD A/c (Overdraft Account)

When a business is allowed to withdraw more than its bank balance.

Examples:

- SBI OD A/c

- ICICI OD A/c

- HDFC OD A/c

- Axis Bank OD A/c

- PNB OD A/c

4. Branch / Divisions

Used to record transactions of different business locations or departments.

Examples:

- Mumbai Branch

- Delhi Office

- Online Division

- Retail Store – Surat

- South Zone Division

5. Capital Account

Indicates the owner’s or partner’s investment in the business.

Examples:

- Ankit Capital

- Partner A Capital

- Opening Capital

- Capital Contribution

- Owner’s Equity

6. Cash-in-Hand

Cash available physically with the business.

Examples:

- Cash

- Petty Cash

- Office Cash

- Sales Collection Cash

- Cash Counter A/c

7. Current Assets

Assets that can be converted into cash within one year.

Examples:

- Sundry Debtors

- Bills Receivable

- Short-Term Investments

- Advance to Staff

- Prepaid Rent

8. Current Liabilities

Liabilities payable within one year.

Examples:

- Sundry Creditors

- Outstanding Salary

- GST Payable

- Advance Received from Customers

- TDS Payable

9. Deposits (Asset)

Fixed or security deposits made by the company.

Examples:

- Security Deposit with Landlord

- Rent Deposit

- Telephone Deposit

- Electricity Deposit

- FD with ICICI Bank

10. Direct Expenses

Expenses directly related to the production or trading activity.

Examples:

- Wages

- Freight Inward

- Power & Fuel

- Carriage Inward

- Packing Charges

11. Direct Incomes

Income from core business activities.

Examples:

- Freight Income

- Commission Received

- Transportation Charges Income

- Service Income

- Consultation Fees

12. Duties & Taxes

Contains all tax-related ledgers.

Examples:

- CGST Payable

- SGST Payable

- IGST Payable

- TDS Payable

- VAT Payable

13. Expenses (Direct)

Same as Direct Expenses – directly linked to production or purchase.

Examples:

- Factory Rent

- Raw Material Cost

- Loading Charges

- Manufacturing Expenses

- Direct Labour

14. Fixed Assets

Long-term assets used in business operations.

Examples:

- Furniture & Fixtures

- Computers

- Office Equipment

- Building

- Vehicles

15. Income (Direct)

(Repeats same as Direct Income) – Main source of revenue.

Examples:

- Sales Income

- Export Service Income

- Project Charges Income

- Freight Service Income

- Product Design Income

16. Income (Indirect)

Earnings not directly from core business.

Examples:

- Interest Received

- Dividend Income

- Rent Received

- Discount Received

- Scrap Sales

17. Indirect Incomes

Same as above, not related to main business.

Examples:

- Sale of Old Furniture

- Sale of Waste Material

- Interest on Bank FD

- Cash Discount Received

- Profit on Asset Sale

18. Investments

Investments made to earn income or for capital gain.

Examples:

- Shares in Tata Steel

- Mutual Funds

- FD in SBI

- Investment in Gold

- Land Purchased for Investment

19. Loans & Advances (Asset)

Loans given or advances for non-trading purposes.

Examples:

- Advance to Staff

- Loan to Partner

- Advance for Machinery Purchase

- Advance Rent Paid

- Loan to Vendor

20. Loans (Liability)

Loans taken by the business.

Examples:

- Loan from SBI

- Vehicle Loan from HDFC

- Machinery Loan from Axis Bank

- Term Loan from ICICI

- Loan from Director

21. Provisions

Expenses payable next year but belong to current year.

Examples:

- Salary Payable (March)

- Bonus Payable

- Leave Encashment Payable

- Audit Fee Payable

- Provision for Tax

22. Purchase Accounts

Used to record business purchases.

Examples:

- Raw Material Purchase

- Finished Goods Purchase

- Local Purchase A/c

- GST Purchase A/c

- Trading Goods Purchase

23. Reserves & Surplus

Accumulated profits or reserved funds.

Examples:

- General Reserve

- Capital Redemption Reserve

- Profit & Loss A/c (Credit Balance)

- Revaluation Reserve

- Retained Earnings

24. Retained Earnings

Cumulative profits not paid out as dividends.

Examples:

- Retained Earnings A/c

- Earnings Reserve

- Unappropriated Profit

- Retained Profit from Previous Year

- Earnings Balance

25. Secured Loans

Loans backed by collateral/security.

Examples:

- Housing Loan

- Gold Loan

- Car Loan (Secured)

- Machinery Loan with Asset Security

- Term Loan with Land Collateral

26. Stock-in-Hand

Closing stock available at the end of the period.

Examples:

- Finished Goods Stock

- Raw Material Stock

- Packing Material Stock

- Trading Goods Stock

- Closing Inventory

27. Sundry Creditors

Vendors to whom the business owes money.

Examples:

- ABC Traders

- XYZ Suppliers

- Ram & Co.

- Raw Material Suppliers

- Software Vendor

28. Sundry Debtors

Customers who owe money to the business.

Examples:

- Ankit Enterprises

- Rahul Distributors

- Shine Traders

- ABC Stores

- Online Customer (Invoice Basis)

29. Suspense A/c

Temporary account to hold unclassified entries.

Examples:

- Suspense – Opening Balance Difference

- Suspense – Unknown Deposit

- Suspense Payment

- Temporary Advance

- Unmatched Entry Account

30. Unsecured Loans

Loans taken without any collateral.

Examples:

- Personal Loan from Friend

- Unsecured Loan from Partner

- Business Loan without Security

- Director’s Loan (Unsecured)

- Loan from NBFC without Collateral