Narration in Tally refers to the brief explanation or description provided for a transaction at the time of entering a voucher. It appears below the ledger account entries and serves as a note explaining why a transaction was made.

📌 Why is Narration Important?

- Clarity in Records: It tells the story behind a transaction, helping anyone reviewing the account understand its purpose.

- Helps in Auditing: During audits, narrations reduce the need for back-and-forth clarifications.

- Saves Time: Instead of opening supporting documents, the narration gives a quick summary of the transaction.

- Legal and Tax Compliance: Well-written narrations support compliance with GST, income tax, and other regulations.

✍️ Where is Narration Used in Tally?

You’ll find narration used in almost all types of vouchers in Tally:

- Payment Voucher: Explaining the reason for payment

- Receipt Voucher: Mentioning the source of income

- Journal Voucher: Giving context to adjustments or provisions

- Contra Voucher: Detailing transfers between bank and cash

- Sales/Purchase Voucher: Adding details about invoice, discount, or tax

( Payment ) Related Narrations

- Being cash paid to M/s XYZ Traders receipt no. 012 dated 1/5/13

- Being cheque issued to M/s XYZ Traders receipt no. 024 dated 10/5/13

- Being amount paid to M/s XYZ Traders from bank through NEFT / RTGS

- ( Being cash paid to M/s XYZ Traders after deducting 2% cash discount vide receipt no.

045 dated 20/5/13 ) - Being advance given to Suresh

- ( Being amount paid for LIC Premium / PPF / Infra Bond in cash / through bank )

( Receipt ) Related Narrations

- Being cash received from M/s XYZ Traders (Cash)

- Being cheque received from M/s XYZ Traders (Cheque)

- Being amount received in bank from M/s XYZ Traders through NEFT / RTGS (Bank)

- Being amount received from M/s XYZ Traders after deducting 2% cash discount

- Being interest received on PPF A/c as per passbook / bank statement

( Banking ) Related Narrations

- Being cash deposited in bank

- Being cash withdrawn from bank

- ( Being bank charges deducted by bank as per bank statement / passbook )

- ( Being interest credited by bank as per bank statement / passbook )

- ( Being interest charged by bank on loan for the period 1-3-13 To 31-3-13 as per bank

statement ) - ( Being bank charges, earlier deducted, reversed by bank as per bank statement )

- ( Being dividend received from M/s XYZ Company Ltd. directly deposited in bank A/c

as per bank statement ) - ( Being cheque received from M/s XYZ Traders returned / dishonoured by bank )

- Being term loan received from bank

- Being loan installment for the month March, 2013 paid to bank

- Being income tax refund for the assessment year 2013-14 deposited / received in bank

( Capital ) Related Narrations

- Being cash brought in business as capital

- Being cash withdrawn for personal use

- Being goods withdrawn for personal use

- Being goods / furniture brought in business as capital

( Purchase ) Related Narration

- Being goods purchased on credit from M/s XYZ Traders

- Being goods purchased for cash from M/s XYZ Traders

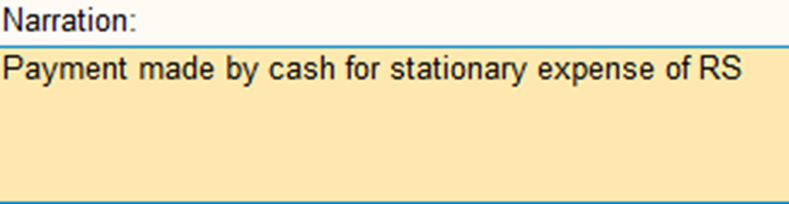

Narration 1 : Payment made by cash for stationary expense of RS

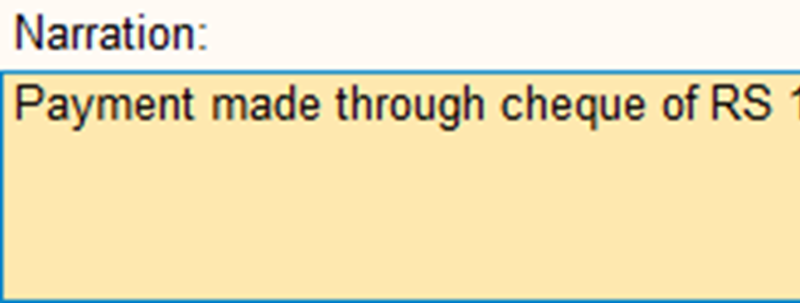

Narration 2 : Payment made through cheque of RS

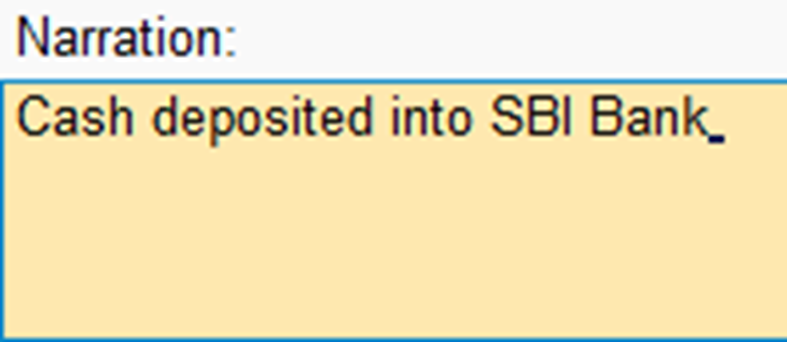

Narration 3 : Cash deposited into SBI Bank

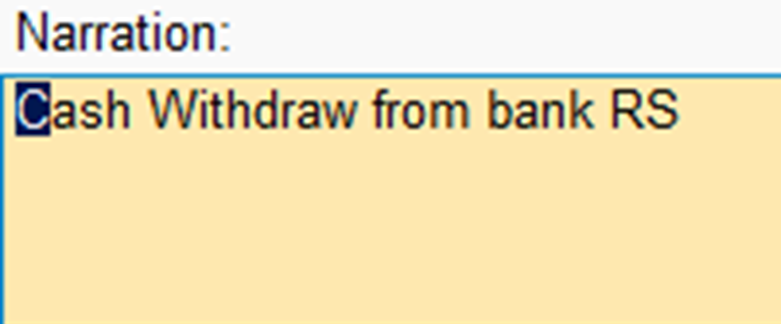

Narration 4 : Cash Withdraw from bank RS