Bank ledgers can be used to record bank deposits, withdrawals, transfers, and other bank transactions. By maintaining a bank ledger, businesses can keep track of their cash flow and reconcile their bank statements. In Tally Prime, a bank ledger is a master record that is used to record all financial transactions related to a particular bank account.

Tips for Managing Bank Ledgers

- Use Accurate Details: Always double-check the bank details to avoid errors in transactions.

- Bank Reconciliation: Use the bank ledger for reconciling your company’s bank transactions with your bank statement.

- Multiple Bank Accounts: You can create separate ledgers for each bank account to keep your records organized.

- Edit Bank Ledger: To make changes later, go to Alter Ledger in the Master menu.

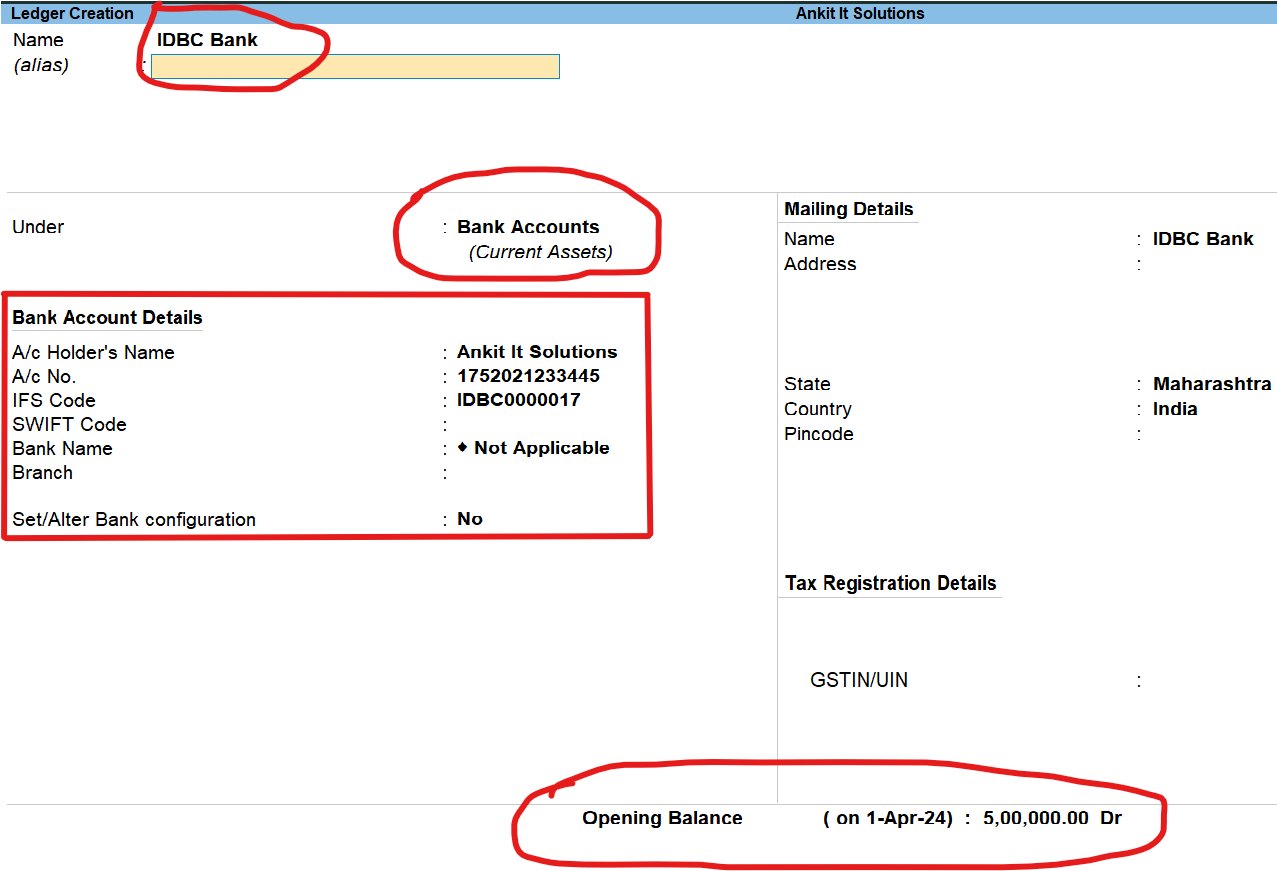

Bank Details

- Name : IDBC Bank

- A/c No : 1752021233445

- IFS Code : IDBC0000017

- Opening Balance : 50,000 Dr

- IDBC Bank Ledger Creation

- Opening Balance: ₹5,00000

- As on: 1st April 2023

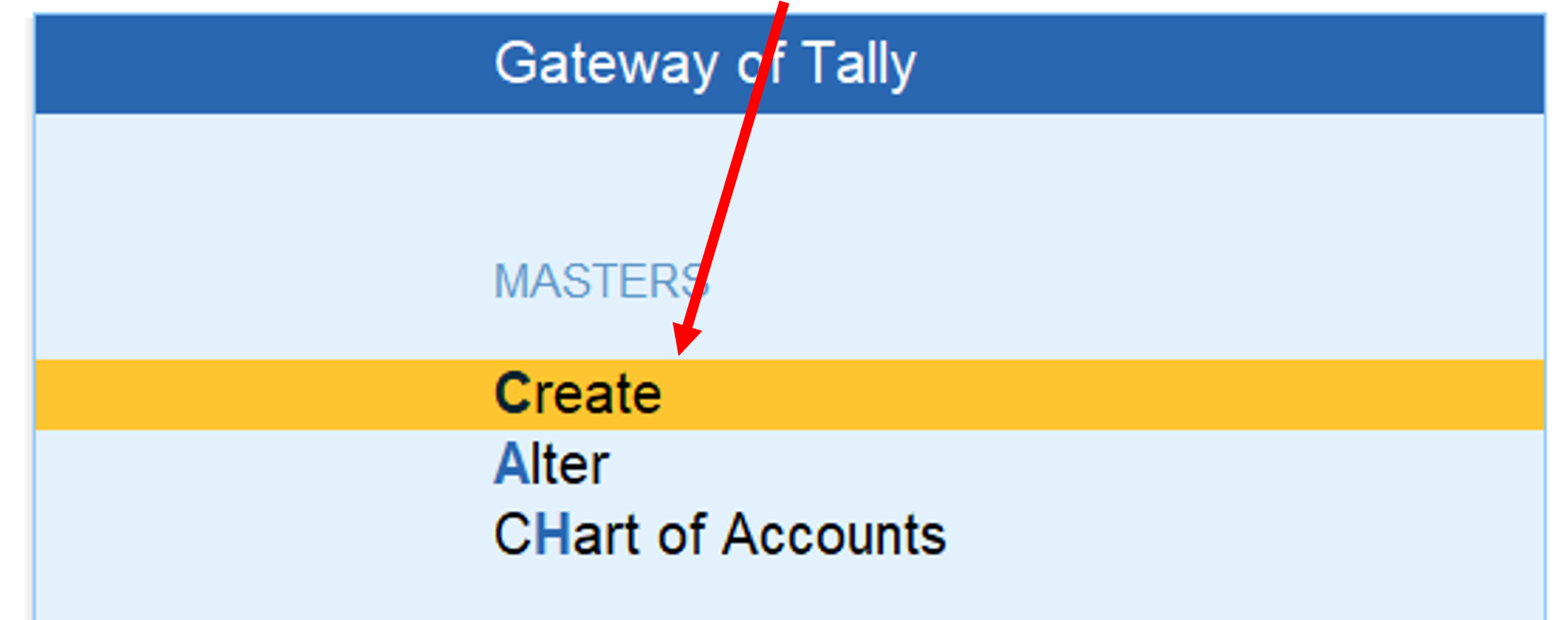

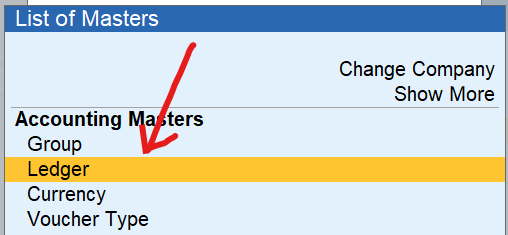

Click on Create from Got Screen.

After entering all the required details, press Enter until you reach the confirmation screen.

Select Yes to save the bank ledger.

Assignments for Practice: Bank Ledger Creation

Assignment 1

- Bank Name: HDFC Bank

- Account Number: 17520212334

- IFSC Code: HDFC0000017

- Opening Balance: ₹50,000 Dr

Assignment 2

- Bank Name: AXIS Bank

- Account Number: 18568212334

- IFSC Code: HDFC0000317

- Opening Balance: ₹0

Assignment 3

- Bank Name: ICICI Bank

- Account Number: 19875234234

- IFSC Code: ICIC0000247

- Opening Balance: ₹25,000 Dr

Assignment 4

- Bank Name: SBI Bank

- Account Number: 11345987654

- IFSC Code: SBIN0004567

- Opening Balance: ₹10,000 Dr

Assignment 5

- Bank Name: Punjab National Bank

- Account Number: 12345678901

- IFSC Code: PUNB0123456

- Opening Balance: ₹0

By completing these assignments, students will gain hands-on experience in creating and managing bank ledgers in TallyPrime. Practice regularly to master this essential accounting task!