It directly has a negative effect on the sellers accounting balance. The credit note informs clients about the credit provided in their account.

🧾 Common Situations for Issuing a Credit Note:

| Scenario | Example |

|---|---|

| Sales return | Customer returns damaged goods worth ₹10,000 |

| Overbilling | Customer was billed ₹12,000 instead of ₹10,000 |

| Post-sale discount | ₹500 discount issued for bulk purchase |

How to record Credit Note in TallyPrime

Step 1 Click on vouchers

- Enter the following details:

-

- Party’s Name: Select the customer or party to whom the credit applies.

- Items or Ledger: Add the returned items or ledger for which the credit is being issued.

- Amount: Enter the total credit amount.

- Narration: Add a note explaining the reason for the credit.

1. Following item retuned to Ghansyam IT Hub

2. Following item retuned to Dubay Mobile Marketing

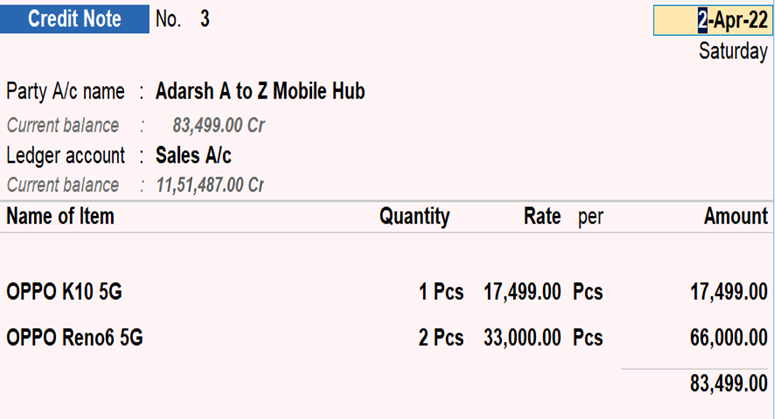

3. Following item retuned to Adarsh A to Z Mobile Hub

Example of a Credit Note Voucher

Scenario:

Your business, ABC Traders, sold 10 items to a customer, but 2 items worth ₹500 each were returned due to damage.

Here’s how you can record this:

- Open Credit Note Voucher.

- Select the customer’s account (e.g., Customer A).

- Under Items, add the product being returned. Enter the quantity (2) and the value (₹500 each).

- The total credit amount will automatically calculate as ₹1,000.

- In the Narration, write: “Goods returned due to damage (Invoice #456).”

- Save the entry.

Now the customer’s account is credited with ₹1,000, and your records are updated.

🧾 Credit Note vs Debit Note

| Basis | Credit Note | Debit Note |

|---|---|---|

| Issued By | Seller | Buyer |

| Used For | Sales return or price reduction | Purchase return or price reduction |

| Account Affected | Customer account is credited | Supplier account is debited |

🧾 Example Entries for Credit Notes

1. Sales Return with GST

Dr. Sales Return A/c ₹10,000

Dr. CGST Output A/c ₹900

Dr. SGST Output A/c ₹900

Cr. Customer A/c ₹11,800

Narration: Being return of goods by customer with GST adjustment.

2. Overcharged Invoice Adjustment

Dr. Sales A/c ₹1,695

Dr. CGST Output A/c ₹152.50

Dr. SGST Output A/c ₹152.50

Cr. Customer A/c ₹2,000

Narration: Being credit note issued for overcharged invoice #202.