A Post-Dated Voucher is a voucher (like Payment, Receipt, Journal, etc.) that is entered today but is dated for a future date. It does not affect your books of accounts or reports until that future date arrives.

Post-dated vouchers help you plan and schedule transactions for future periods, making it easier to manage your finances, and they are typically associated with cheques, payments, or receipts scheduled for a later date.

They help in better planning, managing cash flow, and avoiding missed entries when the actual payment/receipt happens later.

Common Use Cases for Post-Dated Vouchers:

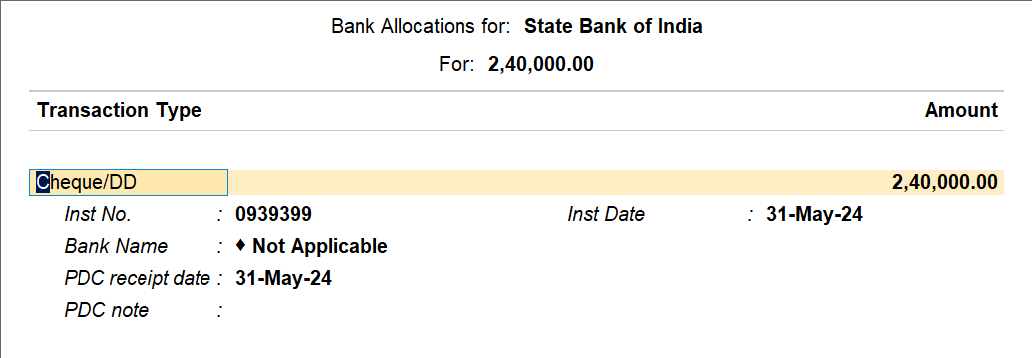

- Post-dated cheques for payments and receipts

- Future-dated salary payments

- Scheduled vendor payments

- EMI payments for loans

Create a Post-Dated Voucher

- Go to Accounting Vouchers

- Select Payment, Receipt, or Journal

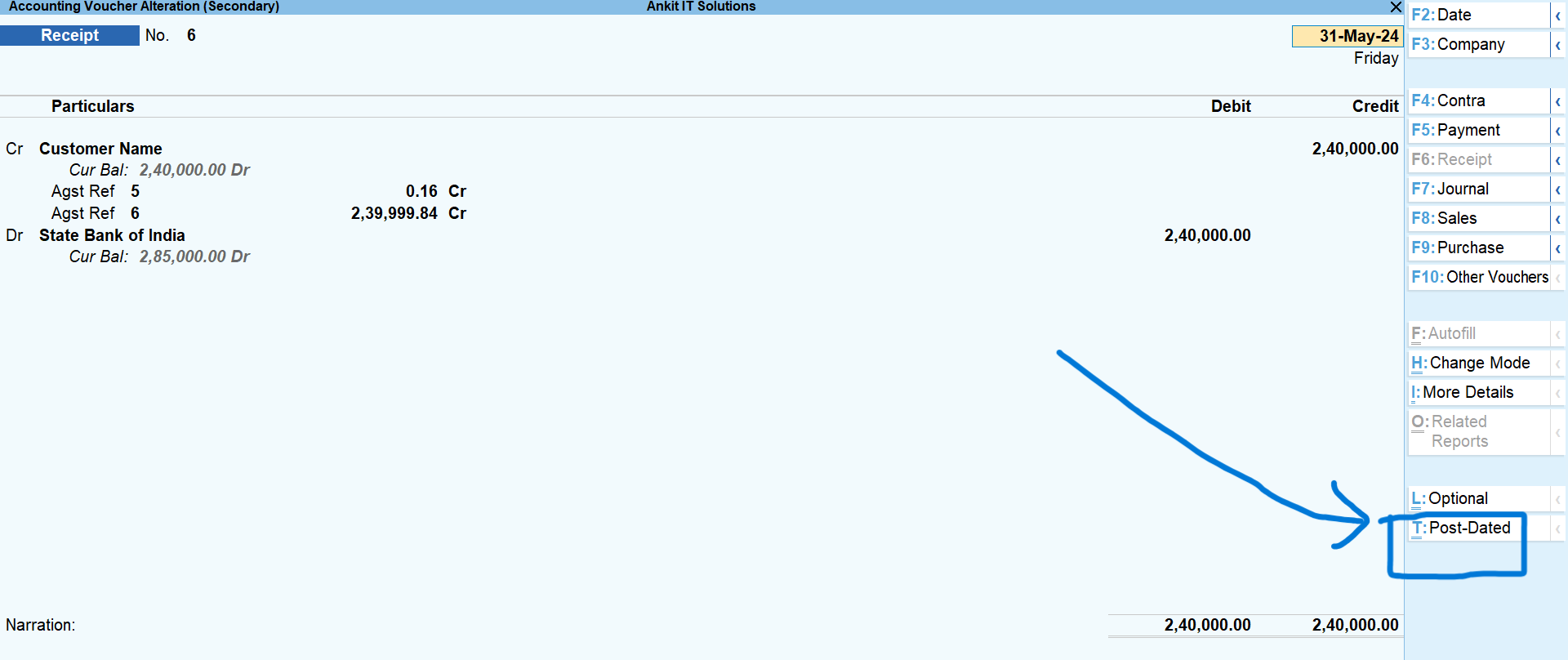

- Press Ctrl + T or click Post-Dated (You’ll see “Post-Dated” at the top)

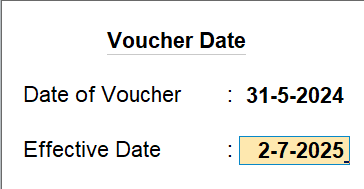

- Enter the future date

- Fill the voucher details

- Save

🎯 This voucher is now saved as Post-Dated. It won’t affect reports until the set date.

Select Voucher and mark it Post Dated

Press F2 and fill dates

Cheque details

Example 1: Post-Dated Cheque Payment

- Party: Ravi Traders

- Amount: ₹10,000

- Date of Cheque: 20-May-2025

- Voucher Entry Date: 10-May-2025

Enter Payment Voucher → Mark it as Post-Dated with 20-May-2025.

It will not reflect in the ledger or bank until 20th May.

Example 2: Future Receipt from Customer

- Customer: ABC Electronics

- Amount: ₹25,000

- Receipt Scheduled: 01-Jun-2025

Use Post-Dated Receipt Voucher to record it now.

It helps plan your cash inflow in reports.

Example 3: Journal Entry for EMI

- Expense: Monthly Loan EMI

- Date: 10th of every month

You can create multiple Post-Dated Journal Vouchers for each EMI.

This way, you can plan future expenses and track them in advance.

The post-dated voucher will not impact your financial accounts until the specified date arrives. On the specified date, the transaction will automatically become active, and its effects will be reflected in your financial statements.