Round Off in TallyPrime is used to adjust small decimal differences in the invoice total. It helps in making the final amount whole or clean, especially when tax and discount calculations lead to amounts like ₹10,542.53.

For example:

- Invoice Total = ₹10,542.53

- Rounded Off = ₹10,543.00

- Round Off Amount = ₹+0.47 (automatically adjusted by Tally)

Why Use Round Off?

- For easier billing and cash handling

- To match printed invoice totals

- Avoids decimal paise confusion

- Ensures cleaner accounting records

Steps to Enable and Use Round Off in TallyPrime

Create Round Off Ledger

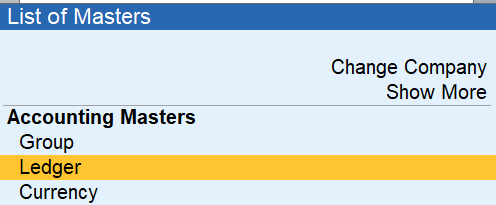

- Go to Gateway of Tally → Create → Ledgers

- Name: Round Off

- Under: Indirect Expenses (for negative value) OR Indirect Incomes (for positive value)

- Type of Ledger: Invoice Rounding

- Rounding Method: Normal Rounding

- Rounding Limit: 0.50 or 1.00

- Save

💡 Tally will auto-adjust the balance and post difference to this ledger.

Add Round Off to Invoice

- Go to Vouchers → Sales (F8) / Purchase (F9)

- Create invoice as usual with items and taxes

- After applying taxes, add a ledger line:

- Select Round Off ledger

- Tally will auto-calculate and round the amount

Click on Create

Click on Ledger

Round Ledger Create

Party Name Create

Purchase A/c

Stock Item Create

Stock Category Create

Vouchers

Purchase Voucher with round off

Sales Vouchers with round off

Assignments

Assignment 1: Round Off in Sales Invoice

- Party: Ravi Traders (Debtor)

- Date: 01-Apr-2025

Invoice Items:

| Item | Quantity | Rate | Amount |

| Laptop | 1 Nos | ₹15,499.49 | ₹15,499.49 |

| Smartphone | 1 Nos | ₹9,999.65 | ₹9,999.65 |

| Sub Total | ₹25,499.14 | ||

| GST 18% | ₹4,589.85 | ||

| Total | ₹30,088.99 | ||

| Rounded | ₹30,089.00 | ||

| Round Off | ₹+0.01 |

Tasks to Perform:

- Create Ravi Traders under Sundry Debtors

- Create stock items: Laptop, Smartphone

- Create Round Off Ledger under Indirect Expenses

- Pass Sales Invoice with GST and auto Round Off

- Check that invoice total becomes ₹30,089.00

Assignment 2: Round Off in Purchase Invoice

- Party: ABC Electronics (Creditor)

- Date: 01-Jan-2025

Invoice Items:

| Item | Quantity | Rate | Amount |

| Laptop | 1 Nos | ₹24,999.40 | ₹24,999.40 |

| Smartphone | 1 Nos | ₹14,999.30 | ₹14,999.30 |

| Sub Total | ₹39,998.70 | ||

| GST 18% | ₹7,199.77 | ||

| Total | ₹47,198.47 | ||

| Rounded | ₹47,198.00 | ||

| Round Off | ₹–0.47 |

Tasks to Perform:

- Create ABC Electronics under Sundry Creditors

- Create stock items: Laptop, Smartphone

- Use the same Round Off Ledger

- Pass Purchase Voucher with GST and auto Round Off

- Check that invoice total becomes ₹47,198.00